Huntington Fannie Mae 1003 2005-2025 free printable template

Show details

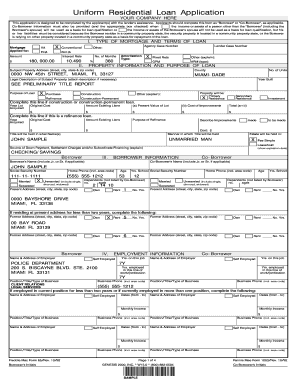

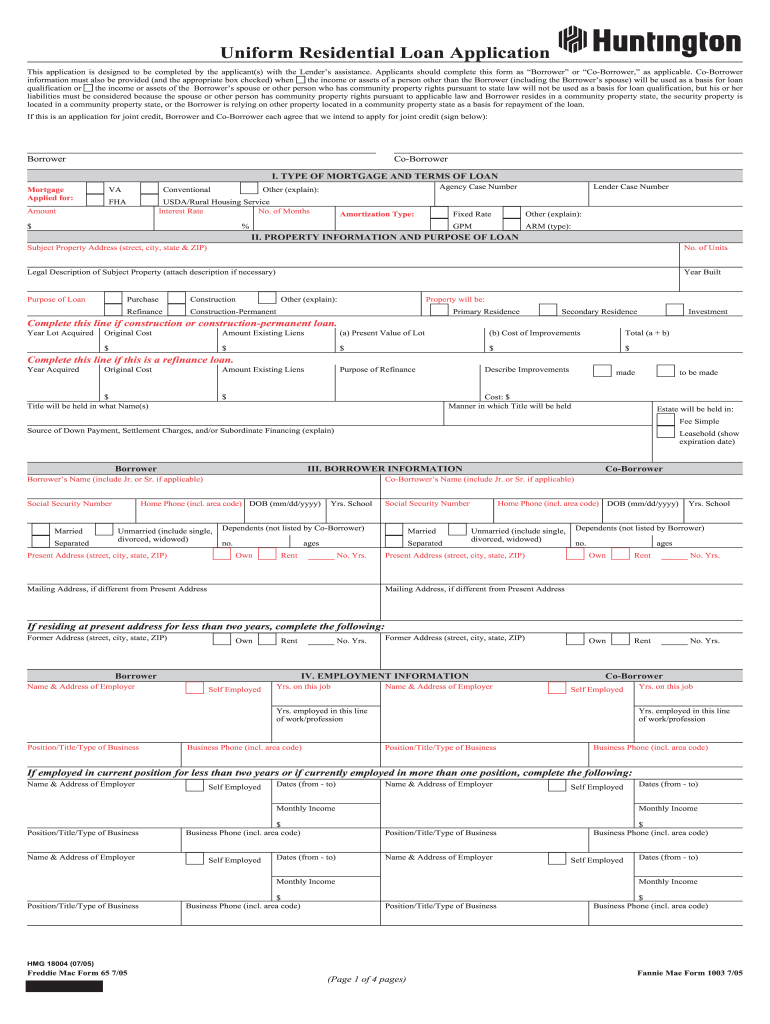

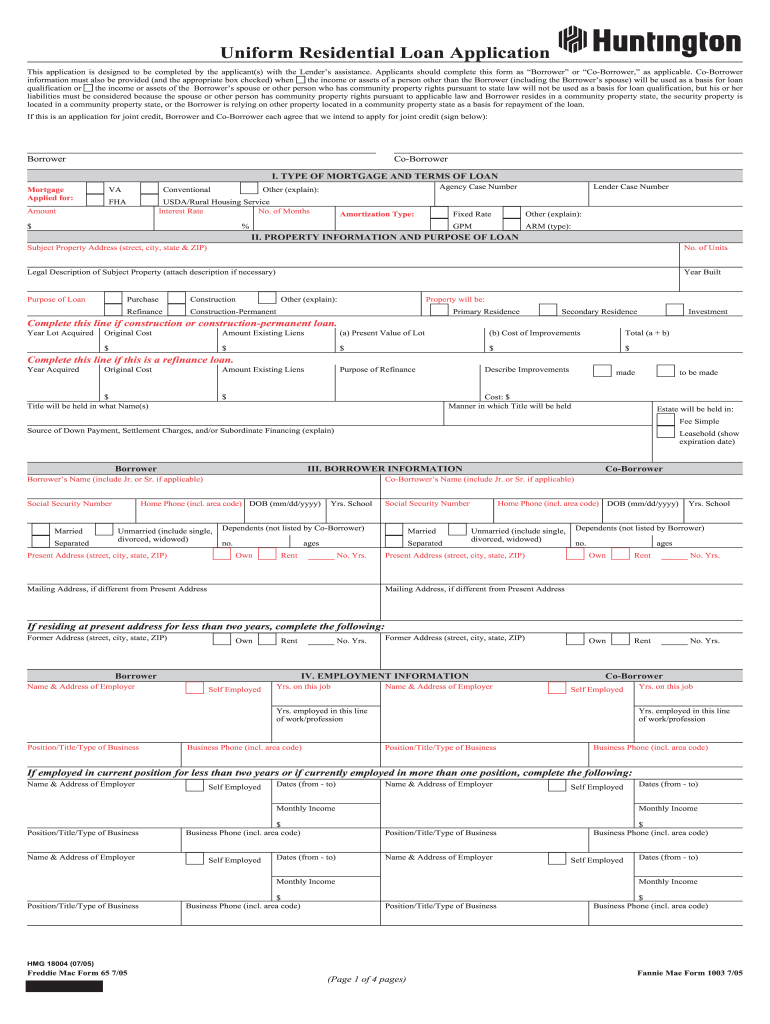

Uniform Residential Loan Application This application is designed to be completed by the applicant(s) with the Lender's assistance. Applicants should complete this form as Born r” or “Co-Borrower,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign loan applicant form pdf

Edit your residential loan box form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your huntington residential loan app form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing huntington fannie uniform residential online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit huntington fannie hmg 18004 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Huntington Fannie Mae 1003

How to fill out Huntington Fannie Mae 1003

01

Obtain the Huntington Fannie Mae 1003 form from the lender's website or office.

02

Begin by filling out Section 1 with the borrower's personal information, including name, address, and social security number.

03

In Section 2, provide details about the mortgage loan being requested, including loan amount, type of mortgage, and purpose.

04

Complete Section 3 by detailing employment information for all borrowers, including employer names, job titles, and income.

05

Section 4 requires information about the borrower's assets and liabilities; provide complete and accurate details.

06

In Section 5, disclose any additional information that may be relevant to the loan application, such as child support or alimony.

07

Review all sections for accuracy, making sure that all required signatures are provided.

08

Submit the completed form along with any required documentation to the lender.

Who needs Huntington Fannie Mae 1003?

01

Individuals seeking a mortgage loan to purchase a home.

02

Homeowners looking to refinance their existing mortgage.

03

Real estate professionals assisting clients with the mortgage application process.

04

Any borrower who is applying for a loan backed by Fannie Mae.

Fill

form

: Try Risk Free

People Also Ask about

What is the SCIF form for mortgage?

The purpose of the Supplemental Consumer Information Form (SCIF) is to collect information on homeownership education and housing counseling and/or language preference to help lenders better understand the needs of borrowers during the home buying process.

What is a lender application?

A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate. The application is extensive and contains information about the property being considered for purchase, the borrower's financial situation and employment history, and more.

What is the 1003 form for mortgage?

The 1003 Form is Fannie Mae's form number for the Uniform Residential Loan Application (URLA). Freddie Mac refers to this as Form 65. The URLA, 1003, and Form 65 are all the same forms and serve as a mortgage loan application.

What is a lender's application form?

The 1003 mortgage application, also known as the Uniform Residential Loan Application, is the standard form nearly all mortgage lenders in the United States use. Borrowers complete this basic form—or its equivalent, Form 65—when they apply for a mortgage loan.

What is known as loan application form?

A loan application form, which can be also called a credit application form, is a document that presents a borrower's income, debt, and other essential information, on which the bank or lender bases to make the decision whether to lend.

What is Form 1103?

Jan. 05, 2023. Fannie Mae and Freddie Mac are reminding lenders that they will require the Supplemental Consumer Information Form (Form 1103) for new conventional loans with application dates on or after March 1.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Huntington Fannie Mae 1003 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your Huntington Fannie Mae 1003 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute Huntington Fannie Mae 1003 online?

pdfFiller has made it simple to fill out and eSign Huntington Fannie Mae 1003. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit Huntington Fannie Mae 1003 on an iOS device?

Create, modify, and share Huntington Fannie Mae 1003 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is Huntington Fannie Mae 1003?

The Huntington Fannie Mae 1003 is a loan application form used by lenders to collect necessary information from borrowers applying for a mortgage. It is also known as the Uniform Residential Loan Application.

Who is required to file Huntington Fannie Mae 1003?

Individuals applying for a mortgage loan through Huntington or other lenders that utilize Fannie Mae guidelines are required to file the Huntington Fannie Mae 1003 form.

How to fill out Huntington Fannie Mae 1003?

To fill out the Huntington Fannie Mae 1003, borrowers must provide personal details such as their name, address, income, employment history, and details about the property they wish to finance. The form must be completed accurately and thoroughly.

What is the purpose of Huntington Fannie Mae 1003?

The purpose of the Huntington Fannie Mae 1003 is to evaluate a borrower's creditworthiness and to gather essential financial information to process a mortgage loan application.

What information must be reported on Huntington Fannie Mae 1003?

The information that must be reported includes the borrower's personal information, employment information, income, assets, debts, details of the property, and any other financial information relevant to the mortgage application.

Fill out your Huntington Fannie Mae 1003 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Huntington Fannie Mae 1003 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.